UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

[ ] Preliminary Proxy Statement

[ ] Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

[X] Definitive Proxy Statement

[ ] Definitive Additional Materials

[ ] Soliciting Material under §240.14a-12

Acadia Realty Trust

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

[X] No fee required.

[ ] Fee paid previously with preliminary materials.

[ ] Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON MAY 5, 20222, 2024

TO THE COMPANY'S SHAREHOLDERS:

Please take notice that the annual meeting of shareholders (the "Annual Meeting"“Annual Meeting”) of Acadia Realty Trust, a Maryland real estate investment trust (the "Company"“Company”, “Acadia”, "we"“we”, "us"“us” or "our"“our”), will be held on Thursday, May 5, 2022,2, 2024, at 1:00 p.m., EDT time. This year's Annual Meeting will be a completely "virtual meeting"virtual meeting of shareholders. You will be able to attend the Annual Meeting, vote and submit your questions during the Annual Meeting via live webcast by visiting www.virtualshareholdermeeting.com/AKR22.AKR24. Prior to the Annual Meeting, you will be able to authorize a proxy to vote your shares at www.proxyvote.com. The Annual Meeting will be held for the purpose of considering and voting upon:

1. | The election of |

2. | The ratification of the appointment of |

3. | The approval, on a non-binding advisory basis, of the compensation of the Company’s Named Executive Officers as disclosed in the |

4. | Such other business as may properly come before the Annual Meeting or any postponement or adjournment thereof. |

The Board of Trustees of the Company recommends a vote "FOR"“FOR” each of the nominees for election as a Trustee and “FOR” each of proposals 2 throughand 3. You should carefully review the accompanying Proxy Statement which contains additional information.information on each of the proposals.

The Board of Trustees has fixed the close of business on March 8, 20225, 2024 as the record date for the determination of shareholders entitled to notice of, and to vote at, the Annual Meeting and any postponement or adjournment thereof.

By order of the Board of Trustees

Jason Blacksberg, Secretary

March 25, 202222, 2024

SHAREHOLDERS, WHETHER OR NOT THEY EXPECT TO ATTEND THE VIRTUAL MEETING, ARE REQUESTED TO AUTHORIZE A PROXY TO VOTE THEIR SHARES ELECTRONICALLY VIA THE INTERNET OR BY COMPLETING AND RETURNING THE PROXY CARD, IF YOU REQUESTED PAPER PROXY MATERIALS. VOTING INSTRUCTIONS ARE PROVIDED IN THE NOTICE OF INTERNET AVAILABILITY OF PROXY MATERIALS, OR, IF YOU REQUESTED PRINTED MATERIALS, THE INSTRUCTIONS ARE PRINTED ON YOUR PROXY CARD AND INCLUDED IN THE ACCOMPANYING PROXY STATEMENT.

ANY PERSON GIVING A PROXY HAS THE POWER TO REVOKE IT AT ANY TIME PRIOR TO THE MEETING, AND SHAREHOLDERS WHO ATTEND THE MEETING MAY WITHDRAW THEIR PROXIES AND VOTE DURING THE MEETING. WE NOTE THAT ATTENDANCE ALONE IS NOT SUFFICIENT TO REVOKE A PREVIOUSLY AUTHORIZED PROXY. IT IS IMPORTANT THAT YOU VOTE YOUR COMMON SHARES. YOUR FAILURE TO PROMPTLY VOTE YOUR SHARES INCREASES THE OPERATING COSTS OF YOUR INVESTMENT.

1

YOU ARE CORDIALLY INVITED TO ATTEND THE VIRTUAL MEETING VIA LIVE WEBCAST BY VISITING WWW.VIRTUALSHAREHOLDERMEETING.COM/AKR22AKR24, BUT YOU SHOULD SUBMIT A PROXY BY INTERNET OR MAIL PRIOR TO THE MEETING, WHETHER OR NOT YOU PLAN TO ATTEND.

ACADIA REALTY TRUST

411 THEODORE FREMD AVENUE, SUITE 300, RYE, NEW YORK 10580

PROXY STATEMENT

FOR THE

ANNUAL MEETING OF SHAREHOLDERS TO BE HELD

May 5, 20222, 2024

GENERAL INFORMATION

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Trustees (the "Board“Board of Trustees"Trustees” or the "Board"“Board”) of Acadia Realty Trust, a Maryland real estate investment trust (the "Company"“Company”), for useexercise at the annual meeting of shareholders scheduled to be held on Thursday, May 5, 2022,2, 2024, at 1:00 p.m., EDT time, via live webcast at www.virtualshareholdermeeting.com/AKR22,AKR24, or any postponement or adjournment thereof (the "Annual Meeting"“Annual Meeting”). This Proxy Statement and accompanying form of proxy were first sent to shareholders on or about March 25, 2022.24, 2024.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to be held on May 5, 2022.2, 2024. This Proxy Statement and the Company's 20212023 Annual Report to shareholders are available electronically at www.acadiarealty.com/proxy.

The Company will bear the costs of the solicitation of its proxies in connection with the Annual Meeting, including the costs of retaining a third party that will assist the Company in preparing, assembling and mailing proxy materials and the handling and tabulation of proxies received. In addition to solicitation of proxies by mail, the Board of Trustees, officers and employees of the Company may solicit proxies in connection with the Annual Meeting by e-mail, telephone, personal interviews or otherwise. Trustees, officers and employees will not be paid any additional compensation for soliciting proxies. Arrangements have been made with brokerage firms, custodians, nominees and fiduciaries to forward solicitation materials to the beneficial owners of common shares of beneficial interest of the Company (the "Common Shares"“Common Shares”), held of record by such persons or firms with their nominees, and in connection therewith, such intermediaries will be reimbursed for their reasonable out-of-pocket expenses in forwarding the materials.

All properly executed and unrevoked proxies in the accompanying form that are received in time for the Annual Meeting will be voted at the Annual Meeting in accordance with the specification thereon. If no specification is made, signed proxies will be voted "FOR"“FOR” each of the nominees for election as a Trustee, “FOR” each of proposals 1 through2 and 3, in each case as set forth in the Notice of Annual Meeting.

You may revoke your proxy and reclaim your right to vote:proxy:

• | by submitting a later-dated proxy either (i) on the Internet, | ||

• | electronically during the Annual Meeting at www.virtualshareholdermeeting.com/ | ||

• |

| ||

| if you are a holder of record, by (i) delivering by mail to the Company's Corporate Secretary at or prior to the Annual Meeting an instrument revoking your proxy or (ii) delivering a subsequently dated proxy with respect to the same Common Shares to the Company’s Corporate Secretary at or prior to the Annual Meeting. | ||

2

Any written notice revoking a proxy should be delivered at or prior to the Annual Meeting to the attention of the Corporate Secretary, Acadia Realty Trust, 411 Theodore Fremd Avenue, Suite 300, Rye, NY 10580.

The Board of Trustees recommends a vote "FOR"“FOR” each of the nominees for election as a Trustee, and “FOR” each of proposals 2 throughand 3.

OUTSTANDING SHARES AND VOTING RIGHTS

The Board of Trustees has fixed the close of business on March 5, 2024 as the record date for determination of shareholders entitled to notice of, and to vote at, the Annual Meeting. As of the close of business on March 8, 2022, the record date for the Annual Meeting,5, 2024, there were 93,618,738102,989,390 Common Shares outstanding. Holders of Common Shares are entitled to one vote for each Common Share registered in their names on the record date. The Board of Trustees has fixed the close of business on March 8, 2022 as the record date for determination of shareholders entitled to

2

notice of, and to vote at, the Annual Meeting. The presence, in person or by proxy, of the holders of Common Shares entitled to cast a majority of all the votes entitled to be cast at the Annual Meeting on any matter will constitute a quorum at the Annual Meeting.

The affirmative vote of a majority of all the votes cast by holders of Common Shares in person or by proxy at the Annual Meeting at which a quorum is present is required for (i) the election of each Trustee, (ii) the ratification of the appointment of BDO USA,Deloitte & Touche LLP as the independent registered public accounting firm for the year ending December 31, 2022,2024, and (iii) the approval, on ana non-binding advisory (non-binding) basis of a resolution approving the compensation of the Company's Named Executive Officers.Officers as described in this Proxy Statement. With respect to any of the foregoing, an “affirmative vote of a majority of all the votes cast” means that the number of votes cast “for” such Trustee-nominee or proposal must exceed the number of votes cast “against” such Trustee-nominee or proposal. There is no cumulative voting in the election of Trustees.

With respect to a particular Trustee-nominee or proposal,any of proposals 2 and 3, holders of Common Shares may vote for or against such Trustee-nominee or proposal by marking "FOR"“FOR” or "AGAINST,"“AGAINST,” respectively, on their proxy.proxy card. Alternatively, holders of Common Shares may abstain from voting on a particular Trustee-nominee or proposal by marking "ABSTAIN"“ABSTAIN” on their proxy.proxy card. Proxies marked "ABSTAIN"“ABSTAIN” (or for which no vote is indicated) are included in determining the presence of a quorum for the Annual Meeting. Except with respect to broker non-votes (see below), properly authorized proxies for which no vote is indicated are treated as votes cast and are voted in accordance with the recommendation of the Board of Trustees as set forth in this Proxy Statement. Accordingly, signed proxies returned without specific voting instructions will be voted “FOR” each of the nominees for election as a Trustee and “FOR” each of proposals 2 through 3. Proxies marked "ABSTAIN,"“ABSTAIN,” on the other hand, are not treated as votes cast with respect to any Trustee-nominee or on proposals 1-32 through 3 and thus are not the equivalent of votes for or against a Trustee-nominee or on any of the other proposals, as the case may be, and will not affect the vote with respect to these matters.

A "broker non-vote"“broker non-vote” occurs when a nominee holding Common Shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power with respect to that proposal and has not received instructions with respect to that proposal from the beneficial owner (despite voting on at least one other proposal for which it does have discretionary authority or for which it has received instructions). Broker non-votes, if any, will not be counted as votes cast and will have no effect on the result of the vote, although they will be considered present for the purpose of determining the presence of a quorum. Of the proposals to be voted upon at the Annual Meeting, the only vote that a nominee may cast without receiving instructions from the beneficial owner is the vote to ratify the appointment of the independent registered public accounting firm of the Company for the year ending December 31, 2022. Signed proxies returned without specific voting instructions will be voted "FOR" each of the nominees for election as a Trustee and “FOR” each of proposals 2-3.2024.

3

MATTERS TO BE CONSIDERED AND VOTED ON AT OUR 20222023 ANNUAL MEETING

Proposal | Board Recommendation | Page |

Proposal No. 1:Election of Trustees | FOR each nominee | X |

Proposal No. 2: Ratification of Appointment of Independent Registered Public Accounting Firm for the year ending December 31, | FOR | X |

Proposal No. 3: Approval, onNon-Binding Advisory | FOR | X |

DETAILS REGARDING THE VIRTUAL ANNUAL MEETING

The Annual Meeting will be held online on Thursday, May 5, 2022,2, 2024, at 1:00 p.m., EDT time, via live webcast. Shareholders of record as of the close of business on March 8, 20225, 2024 will be able to attend, participate in, and vote at the Annual Meeting online by accessing www.virtualshareholdermeeting.com/AKR22AKR24 and following the log in instructions below. Even if you plan to attend the Annual Meeting online, we recommend that you authorize a proxy to vote your shares as described herein so that your vote will be counted if you decide not to attend the Annual Meeting.

Access to the Audio Webcast of the Annual Meeting. The live audio webcast of the Annual Meeting will begin promptly at 1:00 p.m., EDT. Online access to the audio webcast will open approximately 30 minutes prior to the start of the Annual Meeting to allow time for

3

our shareholders to log in and test the computer audio system. We encourage our shareholders to access the Annual Meeting prior to the start time.

Log in Instructions. To attend the Annual Meeting, log in at www.virtualshareholdermeeting.com/AKR22.AKR24. Shareholders will need their unique 16-digit control number, which appears on the front of your voting instrument. In the event that you do not have a control number, please contact your broker, bank, or other nominee as soon as possible and no later than April 29, 2022,26, 2024, so that you can be provided with a control number and gain access to the Annual Meeting. If, for any reason, you are unable to locate your control number, you will still be able to join the Annual Meeting as a guest by accessing www.virtualshareholdermeeting.com/AKR22AKR24 and following the guest log-in instructions; you will not, however, be able to vote or ask questions.

Submitting Questions at the Annual Meeting. As part of the Annual Meeting, we will hold a live question and answer session, during which we intend to answer appropriate questions of general shareholder interest submitted during the meeting that are pertinent to the Company and the Annual Meeting matters, as time permits. Questions and answers will be grouped by topic and substantially similar questions will be grouped and answered once. Any appropriate questions of general shareholder interest submitted during the Annual Meeting that are pertinent to the Company and Annual Meeting matters and any answers thereto provided by management (including any such questions that were not answered during the Annual Meeting due to time constraints) will be made available in the “Investors – Annual Meeting” section of the Company’s website promptly following the Annual Meeting.

Technical Assistance. Beginning 30 minutes prior to the start of and during the Annual Meeting, we will have a support team ready to assist shareholders with any technical difficulties they may have accessing or hearing the Annual Meeting. If you encounter any difficulties accessing the virtual Annual Meeting during the check-in or meeting time, call our support team, the contact for which will be posted on www.virtualshareholdermeeting.com/AKR24.

Availability of live webcastLive Webcast to team membersTeam Members and other constituentsOther Constituents. The live audio webcast will be available to not only our shareholders but also to our team members and other constituents. Such constituents will be able to attend the virtual Annual Meeting by accessing www.virtualshareholdermeeting.com/AKR22AKR24 and following the guest log-in instructions; they will not, however, be able to vote or ask questions.

4

PROPOSAL 1 - ELECTION OF TRUSTEES

There are nineeight nominees for election as Trustees, each to serve for a one-year term, expiring at the 20232025 annual meeting of shareholders and until their respective successors are duly elected and qualify. Election of each Trustee requires the affirmative vote of a majority of all the votes cast by holders of Common Shares in person or by proxy at the Annual Meeting.

The Company's Declaration of Trust provides that the Board of Trustees may be composed of up to a maximum of 15 members. The Board of Trustees currently consists of nine Trustees, each of whom serves until the next annual meeting of shareholders and until his or her successor is duly elected and qualifies. As part of the Board’s ongoing commitment to refreshment, which has included the recent appointments of three new Trustees since 2021 as well as two Trustee retirements during that period, one of our longest-serving Trustees, Douglas Crocker II, will transition off the Board and all committees on which he serves following the Annual Meeting and will not be standing for re-election. Following Mr. Crocker’s retirement, the Board will consist of eight members. As a highly respected and qualified industry leader, Mr. Crocker has provided outstanding expertise and an independent voice to the Board for 20 years. We express our deepest gratitude to Mr. Crocker for his significant contributions to the Company.

As stated elsewhere herein, the enclosed proxy will be voted “FOR” the election as a Trustee of each nominee whose name is set forth below unless a contrary instruction is given. All of the nominees currently serve as Trustees of the Company. Management believes that all of the nominees are willing and able to serve the Company as Trustees. If any nominee at the time of election is unable or unwilling to serve or is otherwise unavailable for election, and as a consequence thereof, other nominees are designated, the persons named in the enclosed proxy or their substitutes will have the discretion and authority to vote or refrain from voting for other nominees in accordance with their discretion.

Trustee Independence

With eight independent Trustees outUpon the election of nine,all nominees, the Board has satisfied its objective thatCompany will meet and exceed the New York Stock Exchange (“NYSE”) requirement for a majority of independent Trustees serving on the Board should consist of independent Trustees. The Board of Trustees has affirmatively determined that each of Messrs. Crocker, Kellar,Denien, McIntyre, Spitz, Wielansky and Zoba, and Mss. LuscombeThurber and ThurberWoodhouse is independent under the listing standards of the New York Stock Exchange.NYSE. In determining this, the Board of Trustees considered, among others, transactions and relationships between each Trustee or any member of his or her immediate family and the Company and its subsidiaries and affiliates. The Board of Trustees has determined that each member of the Audit, Compensation and Nominating and Corporate Governance Committees is independent under the criteria for independence set forth in the listing standards of the New York Stock Exchange. Upon the election of all nominees, the Company will continue to meet the New York Stock Exchange requirement for a majority of independent Trustees serving on the Board of Trustees.NYSE.

Nominees for Election as Trustees

The table below provides a summary of information about the nominees for election as TrusteesTrustees. We believe each of our nominees brings a different variety of experience in the listed core competencies and contributes to the collective significant expertise of the Company:Board. This summary is not intended to be an exhaustive list of our nominees’ skills, and further information on each nominee’s experience, skills and qualifications is set forth in the biographies on pages 6 to 10 below.

Committee Memberships | Experience | |||||||||||||||||

Name | Independent | Gender Diversity | Ethnic/Racial Diversity | Audit | Compensation | Nominating and Corporate Governance | Investment/Capital Markets | CEO/President/Founder | REIT/Real Estate | Consumer Retail | Real Estate Development | Investment/Capital Markets | Financial Expertise* | Other Public Company Board / Corporate Governance Oversight | Risk Management | Environmental & Social Responsibility | Human Capital Management | |

Kenneth F. Bernstein | No |

| | | | | | | | |||||||||

Mark A. Denien | Yes |

| | | | | | | ||||||||||

Kenneth A. McIntyre | Yes | |

|

| | | | | | | | | | |||||

5

William T. Spitz | Yes |

|

|

| | | | | | | ||||||||

Lynn C. Thurber | Yes | |

|

| | | | | | | | | | |||||

Lee S. Wielansky | Yes |

| | | | | | | | | | |||||||

Hope B. Woodhouse | Yes | |

| | | | | | | | ||||||||

C. David Zoba | Yes |

|

| | | | | | | | |

Notes:

4

|

|

|

| Committee Memberships | |||

Name | Age | Trustee Since | Independent | Audit | Compensation | Nominating and Corporate Governance | Investment/Capital Markets |

Kenneth F. Bernstein | 60 | 1998 | No |

|

|

| X |

Douglas Crocker II | 81 | 2003 | Yes |

| X | X | X(1) |

Lorrence T. Kellar | 84 | 2003 | Yes | X | X |

|

|

Wendy Luscombe | 70 | 2004 | Yes | X |

| X(1) |

|

Kenneth A. McIntyre | 61 | 2021 | Yes |

|

| X |

|

William T. Spitz | 70 | 2007 | Yes | X | X(1) |

| X |

Lynn C. Thurber | 75 | 2016 | Yes | X (1) | X |

|

|

Lee S. Wielansky | 70 | 2000 | Yes |

|

|

| X |

C. David Zoba | 70 | 2015 | Yes |

|

| X | X |

Notes:* Denotes qualification as an Audit Committee Financial Expert under Securities and Exchange Commission (“SEC”) rules in connection with service on an audit committee at the Company or other public company.

(1) Chairman of the committee.

Kenneth F. Bernstein, age 6062

Professional Experience:Mr. Bernstein has been Chief Executive Officer ("CEO"(“CEO”) of the Company since January of 2001. He has been the President and a Trustee of the Company since August 1998, when the Company acquired substantially all of the assets of RD Capital, Inc. ("RDC"(“RDC”) and its affiliates. From 1990 to August 1998, Mr. Bernstein was the Chief Operating Officer of RDC. In such capacity, he was responsible for overseeing the day-to-day operations of RDC, its management companies, and its affiliated partnerships. Prior to joining RDC, Mr. Bernstein was an associate at the New York law firm of Battle Fowler, LLP. Mr. Bernstein received his Bachelor of Arts Degree from the University of Vermont and his Juris Doctorate from Boston University School of Law. Mr. Bernstein sits on the Board of Trustees of the International Council of Shopping Centers and served as its 2017/2018 Chairman. He has previously served as a co-chair of the Board of Governors for the National Association of Real Estate Investment Trusts ("NAREIT"(“NAREIT”), and currently serves asis a Global Governing Trusteemember of Urban Land Institute ("ULI"(“ULI”). and the Real Estate Roundtable. He is also a member of the World President’s Organization (YPO-WPO), where he was the founding chairman of the Real Estate Network and currently sits on the Board of Advisors. Mr. Bernstein is a member of the Board of Trustees of Golub Capital. Mr. Bernstein received his Bachelor of Arts Degree from the University of Vermont and his Juris Doctorate from Boston University School of Law.

Trustee Qualifications:Qualifications: The Board believes Mr. Bernstein's qualifications to sit on the Boardas a Trustee include his extensive real estate, management and board experience. Highlightsexperience, highlights of these qualifications include Mr. Bernstein's:which are listed below:

•

•

•

•

•

Douglas Crocker II,Mark Denien, age 8157

Professional Experience: Mr. CrockerDenien has been a Trustee of the Company since November 2003.October 2022. Mr. CrockerDenien has been the managing partnerover 30 years of DC Partners LLC since 2013. He was the Chief Executive Officer of Equity Residential, a multi-family residential real estate investment trust ("REIT"), from December 1992 until his retirement in December of 2002. During Mr. Crocker's tenure, Equity Residential grew from 21,000 apartments with a total market capitalization of $700 million to a $17 billion company with over 225,000 apartments. Mr. Crocker was also a former Managing Director of Prudential Securities, and from 1982 to 1992 served as Chief Executive

5

Officer of McKinley Finance Group, a privately held company involved with real estate, banking and corporate finance. From 1979 to 1982, Mr. Crocker was President of American Invesco, the nation's largest condominium conversion company, and from 1969 to 1979 served as Vice President of Arlen Realty and Development Company. He is a former member of the board of directors of the real estate investment trust Colony Capital, Inc. In addition, Mr. Crocker serves as a trustee of Milton Academy and the New Bedford Whaling Museum. Mr. Crocker has been a five-time recipient of Commercial Property News' Multifamily Executive of the Year Award, a three time-winner of their REIT Executive of the Year Award, a three-time winner of Realty Stock Review's Outstanding CEO Award, and received NAREIT's 2010 Edward H. Linde Industry Leadership Award. Mr. Crocker is also a member of the NACD.

Trustee Qualifications: The Board believes Mr. Crocker's qualifications to sit on the Board include his extensive CEO, board, financial and real estate experience. Highlights of these qualifications include Mr. Crocker's:

Lorrence T. Kellarindustry, having served multiple executive roles from 2005 to October 2022 at Duke Realty Corporation (“Duke Realty”), age 84

Professional Experience: a publicly traded REIT in the S&P 500, prior to its recent merger with Prologis, Inc. (“Prologis”) in 2022. Mr. Kellar has beenDenien most recently served as Executive Vice President, Chief Financial Officer of Duke Realty, a Trusteerole he held since 2013. As Chief Financial Officer, Mr. Denien oversaw all financial functions for the company, including capital markets, accounting, taxation, investor relations, treasury, and information technology. Mr. Denien is also a Certified Public Accountant, and prior to joining Duke Realty, he was an audit and advisory partner for KPMG, LLP (“KPMG”), focused on the real estate and construction industries. He began his career with KPMG in 1989. Mr. Denien is currently the Chair of the Company since November 2003Board of Directors of Goodwill Industries of Central and Southern Indiana. He is also an "audit committee financial expert" as that term is defined byAdvisory Board Member of the U.S. Securities and Exchange Commission ("SEC"). Mr. Kellar was Vice President at Continental Properties, a retail and residential developer from November 2002 until his retirement in November 2009. In 2021, he became a Director of Mobil Infrastructure Corporation, a publicly registered, non-listed company specializing in parking facilities. He recently retired as chairman of Multi-Color Corporation and also retired from the boards of Frisch’s Restaurant, Inc., and the Spar Group. Prior to joining Continental Properties in 2002, Mr. Kellar served as Vice President ofIndiana University Center for Real Estate with Kmart Corporation from 1996 to 2002. From 1965 to 1996, Mr. Kellar served with The Kroger Co., the country's largest supermarket company, where his final position was Group Vice President of FinanceStudies and Real Estate. Mr. Kellar is also a member of the NACD.investment committee for the University’s real estate private equity fund. In addition, Mr. Denien is a real estate and finance guest lecturer at Indiana University.

Trustee Qualifications:Qualifications: The Board of Trustee believes Mr. Kellar'sDenien’s qualifications to sit on the Boardas a Trustee include his extensive real estate development, public company board, asset managementinvestment, capital markets and mergers and acquisitions accounting experience, highlights of which are listed below:

6

Wendy Luscombe, age 70

Professional Experience: Ms. Luscombe has been a Trustee of the Company since May 2004. Ms. Luscombe has served on the boards of companiesover 30 years’ experience in the real estate mutual fund, reinsurance and manufacturing industries in the US, Europe, and Bermuda. Ms. Luscombe has represented two of the largest European institutional investors in their US real estate and alternative asset strategies. For 11 years, she was CEO of a REIT sponsored by a UK pension fund. Ms. Luscombe is currently actively involved in pursuing her interests in information security, risk management and renewable energy. She has fulfilled the training requirements for CISSP (Certified Information Systems Security Professional) and is understanding renewable energy by living entirely off the grid on solar and geothermal energy sources.

6

Trustee Qualifications: The Board believes Ms. Luscombe's qualifications to sit on the Board include her extensive real estate operational background, CEO experience, asset management experience, extensive board service and strong corporate governance, information security and risk management background. Highlights of these qualifications include Ms. Luscombe's:

7

Kenneth A. McIntyre, age 6163

Professional Experience:Mr. McIntyre has been a Trustee of the Company since March 2021. Mr. McIntyre has over 25 years of experience in the commercial real estate industry. He is the Chief Executive OfficerCEO of the Real Estate Executive Council (REEC)(“REEC”), a trade association for minority executives in the commercial real estate industry, and the founder and Managing Principal of PassPort Real Estate, LLC, a New York-based consulting firm focused on commercial real estate, infrastructure and diversity. Mr. McIntyre previously served as the Executive Advisor for the Office of Diversity and Inclusion at the Port Authority of New York and New Jersey, and as the Executive Director for REAP (TheThe Real Estate Associates Program),Program, a non-profit that is focused on increasing the diversity of talent in the commercial real estate industry. Mr. McIntyre was a Senior Vice President and Head of Commercial Real Estate at Hudson City Savings Bank from May 2014 to May 2016. Prior to joining Hudson City Savings Bank, Mr. McIntyre was a Managing Director in MetLife’s Real Estate Investments Group, where he was also a voting member of the Investment Committee for Commercial Mortgages. Prior to joining MetLife, Mr. McIntyre held senior origination and relationship management roles at KeyBank, GE Capital, UBS and Chase. Mr. McIntyre is currently a member of the Board of Directors of Newmark Group, Inc. (Nasdaq: NMRK), where he serves as chairpersonChair of the ESG Committee,Environmental, Social and isGovernance (“ESG”) and Audit Committees, and as a member of the AuditCompensation Committee, and Compensation Committees. Mr. McIntyre is also a member of The Real Estate Roundtable, where he serves on the Equity, Diversity and Inclusion Committee. Mr. McIntyre is also a Member of the Board of Governors for the Real Estate Board of New York. In addition, Mr. McIntyre serves on the Boards of the National Jazz Museum of Harlem, the Yorkville Youth Athletic Association, and R*E*N*T, and is a member of the Advisory Board for the Council of Urban Real Estate (CURE, f/k/a African American Real Estate Professionals of New York).T. Mr. McIntyre earned a B.S. in Economics with a concentration in Finance from Florida A&M UniversityUniversity.

Trustee Qualifications: The Board believes Mr. McIntyre's qualifications to sit on the Boardas a Trustee include his executive, financial management, and board experience. Highlightsexperience, highlights of these qualifications include Mr. McIntyre's:which are listed below:

•

•

•

•

7

William T. Spitz, age 7072

Professional Experience:Mr. Spitz has been a Trustee of the Company since August 2007. Mr. Spitz is a principal and past Director of Diversified Trust Company, a private wealth management trust company. He served as Vice Chancellor for Investments and Treasurer of Vanderbilt University, Nashville, Tennessee from 1985 to July 2007. As Vice Chancellor for Investments at Vanderbilt, Mr. Spitz was responsible for managing the University's $3.5 billion endowment. He was also a member of the Senior Management Group of the University, which is responsible for the day- to-dayday-to-day operations of the institution. During his tenure, the Vanderbilt endowment earned returns in the top 10% of a broad universe of endowments for multiple time frames. While at Vanderbilt, Mr. Spitz conducted asset allocation studies and implemented detailed investment objectives and guidelines, developed a comprehensive risk management plan, invested in approximately two hundred limited partnerships in five illiquid assets classes, selected new custodians for both the endowment fund and the University's charitable remainder trusts and implemented a more aggressive approach to working capital management, which increased returns by 2% per annum. In addition, Mr. Spitz was also on the faculty of Vanderbilt University as Clinical Professor of Management at the Owen Graduate School of Management. He has also held various high-level positions with successful asset management companies and has served on the boards of several companies, including Cambium Global Timber Fund, The Common Fund, MassMutual Financial, and the Bradford Fund. He has also served on multiple advisory committees, including Acadia's Opportunity Fund Advisory Boards, on which he served from 2001 to July 2007. Mr. Spitz is a published author and frequent speaker at industry conferences and seminars.

8

Trustee Qualifications: The Board believes Mr. Spitz's qualifications to sit on the Boardas a Trustee include his asset management experience as well as real estate development, board, fund, and REIT experience. Highlightsexperience, highlights of these qualifications include Mr. Spitz's:which are listed below:

•

•

•

•

•

•

•

•

•

Lynn C. Thurber, 7577

Professional Experience:Ms. Thurber has been a Trustee of the Company since March 2016. Ms. Thurber is past chairman (2007- 2017)(2007-2017) of LaSalle Investment Management, a global real estate money management firm with over $55 billion of assets under management, investing in private real estate as well as publicly-tradedpublicly traded real estate companies on behalf of institutional and individual investors. Prior to becoming chairman of LaSalle Investment Management, Ms. Thurber was the Chief Executive OfficerCEO of LaSalle Investment Management from March 2000 to December 2006 and co-president from December 1994 to March 2000. Prior to Alex Brown, Kleinwort Benson (“ABKB”) Realty Advisors’ merger with LaSalle Partners in 1994, Ms. Thurber was Chief Executive OfficerCEO of that company.ABKB. Before joining ABKB in 1992, she was a principal at Morgan Stanley & Co. Ms. Thurber is a part-time employee of LaSalle Investment Management, an independent subsidiary of JLL Incorporated (NYSE:JLL) (2018-Present) for the purpose of serving as chairman of the board of JLL Income Property Trust, an SEC registered, non-traded REIT. Ms. Thurber earned an M.B.A. from Harvard Business School and an A.B. from Wellesley College. Ms. Thurber is a member ofserved on the boardBoard of Duke Realty Corporation.from 2008 until the closing of its acquisition by Prologis in 2022. Ms.

8

Thurber is a trustee and a past global Chairman of ULI-Urban Land Institute.Institute, and is a past member of the advisory board and past Chair for ULI’s Randall Lewis Center for Sustainability in Real Estate. In addition, Ms. Thurber is currently a member of the Wellesley College Business Leadership Council and a member of the board of the Bitterroot Land Trust. Ms. Thurber was the 2013 recipient of the Landauer White award from the Counselors of Real Estate and the 2015 recipient of the Lifetime Achievement Award from the ULI District Council of Chicago. Ms. Thurber earned an MBA from Harvard Business School and an A.B. from Wellesley College.

Trustee Qualifications: The Board believes Ms. Thurber’s qualifications to sit on the Boardas a Trustee include her extensive real estate investment, capital markets and board experiences. Highlightsexperiences, highlights of these qualifications include Ms. Thurber's:which are listed below:

•

•

•

•

•

•

•

Lee S. Wielansky, age 7072

Professional Experience:Mr. Wielansky has been a Trustee of the Company since May 2000 and the Lead Trustee since 2004. Mr. Wielansky has been Chairman and Chief Executive OfficerCEO of Midland Development Group, Inc., which focuses on the development of retail properties in the mid-westMidwestern and southeast,Southeastern United States, since May 2003. From November 2000 to March 2003, Mr. Wielansky served as Chief Executive OfficerCEO and President of JDN Development Company, Inc. and a director of JDN Realty Corporation through its merger with Developers Diversified Realty Corporation in 2003. He was also a founding partner and Chief Executive OfficerCEO of Midland Development Group, Inc. from 1983 through 1998 when the company sold its assets to Regency Centers Corporation.Corporation (NASDAQ: REG). Mr. Wielansky is a member of the Board of Brookdale Senior Living (NYSE: BKD) and a member of the NACD.National Association of Corporate Directors.

9

Trustee Qualifications: The Board believes Mr. Wielansky's qualifications to sit on the Boardas a Trustee include his real estate development, public company board, fund, asset management and CEO experience. Highlightsexperience, highlights of these qualifications include Mr. Wielansky's:which are listed below:

•

•

•

•

•

•

•

•

•

Hope B. Woodhouse, age 67

Professional Experience: Ms. Woodhouse has been a Trustee of the Company since January 2023. Ms. Woodhouse served as Chief Operating Officer (“COO”) and as a member of the management committee of Bridgewater Associates, Inc., a global SEC Registered Investment Advisor from 2005 to 2009. As COO she was responsible for Accounting, Operations, Compliance, Counterparty Relations, Finance, Human Resources and Facilities. Between 2003 and 2005, Ms. Woodhouse was President and COO of Auspex Group, L.P., a global macro hedge fund. She was COO and a member of the management committee of Soros Fund Management LLC, a global investment company from 2000 to 2003. Prior to that, she was Treasurer of the Funds at Tiger Management L.L.C. from 1998 to 2000 and before that she was a Managing Director for Fixed Income at Salomon Brothers Inc. from 1983 to 1998. Ms. Woodhouse presently serves as an independent director on the Boards of Two Harbors Investment Corp. (NYSE: TWO), where she has served since 2012 and is chair of the Risk Oversight Committee and a member of the Audit Committee, and Granite Point Mortgage Trust Inc. (NYSE: GPMT), where she has served since 2017 and is chair of the Compensation Committee and a member of the Nominating and Corporate Governance and Audit Committees. She recently joined the Board of Monro, Inc. (Nasdaq: MNRO) and will serve on the Compensation and Audit Committees. Ms. Woodhouse previously served as a director of Piper Jaffray Companies (NYSE: PIPR), Seoul Securities Co. Ltd., Soros Funds Limited, The Bond Market Association and as a member of the investment committee at Phillips Academy, Andover, Massachusetts. Ms. Woodhouse also serves on the board of Children’s Services Advisory Committee of Indian River County and is a trustee of the Tiger Foundation. Ms. Woodhouse received an A.B. degree in Economics from Georgetown University and an M.B.A. from Harvard Business School.

Trustee Qualifications: The Board believes Ms. Woodhouse’s qualifications as a Trustee include her extensive capital markets and investment experience across a wide range of products and markets as well as her board experiences, highlights of which are listed below:

10

C. David Zoba, age 7072

Professional Experience:Mr. Zoba has been a Trustee of the Company since August 2015. Mr. Zoba retired on January 31, 2016 from his position as Senior Real Estate Strategy advisor for Gap Inc. (NYSE: GPS) that he held since 2015, after having served, since 2009, as Senior Vice President of Global Real Estate and Store Development for Gap Inc., the $15 billion retailer operating as Gap, Banana Republic, Old

9

Navy, Athleta, Intermix and Outlet Brands. Immediately prior to joining Gap, Inc., Mr. Zoba was Principal and Chief Operating OfficerCOO for Steiner ++Steiner Associates, one of the country's most respected mixed-use retail developers. Mr. Zoba was Chairman of Jones Lang LaSalle Incorporated’s (“JLL”) Global Retail Leasing Board from 2015-2022, and now serves as Senior Advisor to JLL. Mr. Zoba is also a past Trustee of the International Council of Shopping Centers and is a consultant to QC Terme (U.S.) Corp., an Italian based spa and wellness company on their expansion in North America. Mr. Zoba also serves on the Board of Café Rio, Inc. and on the Board of White Water Express Car Wash, LLC. Both Café Rio, Inc. and White Water Express Car Wash LLC are portfolio companies of Freeman Spogli & Co., a private equity firm, where he serves as an Industry Executive. From November 2004 through April 2006, Mr. Zoba served as President and Chief Operating OfficerCOO of Premier Properties, a real estate development company. From 2001 through late 2004, Mr. Zoba worked for Galyan'sGalyan’s Trading Company, Inc., where, as EVP,Executive Vice President, he helped create and launch a specialty sporting goods retailer that later became part of Dick's Sporting Goods. In the mid-1990s, Mr. Zoba was with The Limited (now L Brands) and served as Chief Transaction Attorney, and then expanded his responsibilities significantly to other areas during his seven years there. Mr. Zoba earned his undergraduate degree from Harvard University and attended the London School of Economics for graduate studies. Mr. Zoba has a Juris Doctorate from Case Western Reserve University Law School. Since July 2015, Mr. Zoba has been Chairman (Non-Executive), Global Retail Leasing Board, with Jones Lang LaSalle Incorporated. Mr. Zoba is also a past Trustee of the International Council of Shopping Centers and is a consultant to QC Terme (U.S.) Corp., an Italian based spa and wellness company on their expansion in North America. Mr. Zoba also serves on the Board of PF Baseline Fitness, a franchisee of Planet Fitness and on the Board of WhiteWater Express LLC.

Trustee Qualifications: The Board believes Mr. Zoba'sZoba’s qualifications to sit on the Boardas a Trustee include his extensive retail, real estate and board experiences. Highlightsexperiences, highlights of these qualifications include Mr. Zoba's:which are listed below:

•

•

•

•

•

Vote Required; Recommendation

The election to the Board of Trustees of each of the nineeight nominees will require the affirmative vote of a majority of all the votes cast by the holders of Common Shares in person or by proxy at the Annual Meeting.

The Board of Trustees unanimously recommends that the shareholders vote "FOR"“FOR” the election of each of the nineeight nominees to the Board of Trustees.

Unless otherwise indicated by a shareholder on a proxy and except with respect to broker non-votes, shares will be voted "FOR"“FOR” the election of each nominee.

Because the election of nominees to the Board of Trustees is a non-routine matter under the listing standards of the New York Stock Exchange,NYSE, brokerage firms, banks and other nominees who hold Common Shares on behalf of clients in "street name"“street name” are not permitted to vote such Common Shares if the client does not provide instructions.

For additional information regarding voting requirements, see "Outstanding“Outstanding Shares and Voting Rights"Rights” above.

PROPOSAL 2 - RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of the Board of Trustees has appointed BDO USA,Deloitte & Touche LLP as the Company's independent registered public accounting firm for the fiscal year ending December 31, 20222024 and has directed that the appointment of the independent registered public accounting firm be submitted for ratification by the shareholders at the Annual Meeting.

Shareholder ratification of the appointment of BDO USA,Deloitte and Touche LLP as the Company's independent registered public accounting firm is not required by the Company's Declaration of Trust, Bylaws or otherwise. However, the Audit Committee is submitting the appointment of BDO USA,Deloitte & Touche LLP to the shareholders for ratification as a matter of what it considers to be good corporate practice. Notwithstanding the ratification of, or failure to, ratify the appointment, the Audit Committee of the Board of Trustees in its discretion may direct the appointment of a different independent accounting firm at any time during the year if the Audit Committee determines that such a change would be in the best interests of the Company.

11

10

Representatives of BDO USA,Deloitte & Touche LLP, the Company's auditors for the fiscal year ended December 31, 2021,2023, are expected to be present at the Annual Meeting and will have the opportunity to make a statement if such representatives desire to do so and will be available to respond to appropriate questions.

Change of Independent Public Accountants: As previously reported in the Company’s Current Report on Form 8-K, dated July 14, 2023, the Audit Committee conducted a competitive process to determine the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2023. Several independent accounting firms were invited to participate in this process, including BDO USA, P.A. (“BDO”), which had been previously engaged as the Company’s independent registered public accounting firm.

As a result of this competitive process, the decision to change the Company’s independent registered public accounting firm and, accordingly, to dismiss BDO, was approved by the Audit Committee on July 13, 2023, and BDO was dismissed effective as of July 13, 2023. Effective as of the same day, the Audit Committee approved the engagement of Deloitte and Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2023.

BDO’s reports on the Company’s consolidated financial statements for the fiscal year ended December 31, 2022, did not contain an adverse opinion or a disclaimer of opinion, nor were they qualified or modified as to uncertainty, audit scope or accounting principles. BDO’s reports on the Company’s consolidated financial statements for the fiscal year ended December 31, 2021 contained an adverse opinion on the effectiveness of the Company’s internal control over financial reporting related to the restatement of the Company’s financial statements as of and for the years ended December 31, 2020 and 2019 due to an error in accounting treatment at the time of the Company’s formation related to the improper consolidation of two investments that are less-than-wholly-owned through the Company's opportunity funds as more fully described in the Company’s Current Report on Form 8-K filed with the SEC on March 1, 2022, but such reports were not otherwise qualified or modified as to uncertainty, audit scope or accounting principles.

During the Company’s two most recent fiscal years pre-dismissal (fiscal years ended December 31, 2022 and December 31, 2021) and the subsequent interim period through July 13, 2023, there were no (i) disagreements (within the meaning of Item 304(a)(1)(iv) of Regulation S-K and the related instructions thereto) with BDO on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure that, if not resolved to the satisfaction of BDO, would have caused BDO to make reference thereto in its reports covering the Company’s consolidated financial statements for such periods and (ii) reportable events (as defined in Item 304(a)(1)(v) of Regulation S-K).

During the two fiscal years ended December 31, 2021 and 2022, neither the Company nor anyone acting on its behalf has consulted with Deloitte & Touche LLP regarding either (i) the application of accounting principles to a specified transaction, either completed or proposed; or the type of audit opinion that might be rendered on the Company’s financial statements, and either a written report was provided to the Company or oral advice was provided that Deloitte & Touche LLP concluded was an important factor considered by the Company in reaching a decision as to the accounting, auditing or financial reporting issue; or (ii) any matter that was either the subject of a disagreement (as defined in paragraph 304(a)(1)(iv) of Regulation S-K) or a reportable event (as described in paragraph 304(a)(1)(v) of Regulation S-K).

Vote Required; Recommendation

The affirmative vote of a majority of all the votes cast by holders of Common Shares in person or by proxy at the Annual Meeting is required to ratify the appointment of BDO USA,Deloitte & Touche LLP as the independent registered public accounting firm for the fiscal year ending December 31, 2022.2024.

The Board of Trustees unanimously recommends that the shareholders vote "FOR"“FOR” the ratification of BDO USA,Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2022.2024.

Unless otherwise indicated by a shareholder on a proxy, shares will be voted "FOR"“FOR” such ratification. Because the ratification of BDO USA,Deloitte & Touche LLP as our independent registered public accounting firm is a routine matter under the listing standards of the New York Stock Exchange,NYSE, brokerage firms, banks, and other nominees who hold Common Shares on behalf of clients in “street name” may vote such Common Shares in their discretion if the client does not provide instructions.

For additional information regarding voting requirements, see "Outstanding“Outstanding Shares and Voting Rights"Rights” above.

12

PROPOSAL 3 – NON-BINDING ADVISORY APPROVAL OF THE COMPANY'S EXECUTIVE COMPENSATION

As required under the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the "Dodd-Frank Act"“Dodd-Frank Act”), the Company is seeking a non-binding, advisory shareholder vote approving the compensation of Named Executive Officers as disclosed in this Proxy Statement in accordance with SEC rules and as discussed in "the Company’s “Compensation Discussion and Analysis,"” the compensation tables and any related material. This vote is not intended to address any specific item of compensation, but rather the overall compensation of the Company's Named Executive Officers and the compensation-related policies and practices described in this Proxy Statement.

The Board and management have thoughtfully designed the Company's executive compensation philosophy, policies and programs tailored with the understanding of the Company's business and the strategic mission of the Company.

The Compensation Committee's executive compensation objectives are as follows:

Vote Required; Recommendation

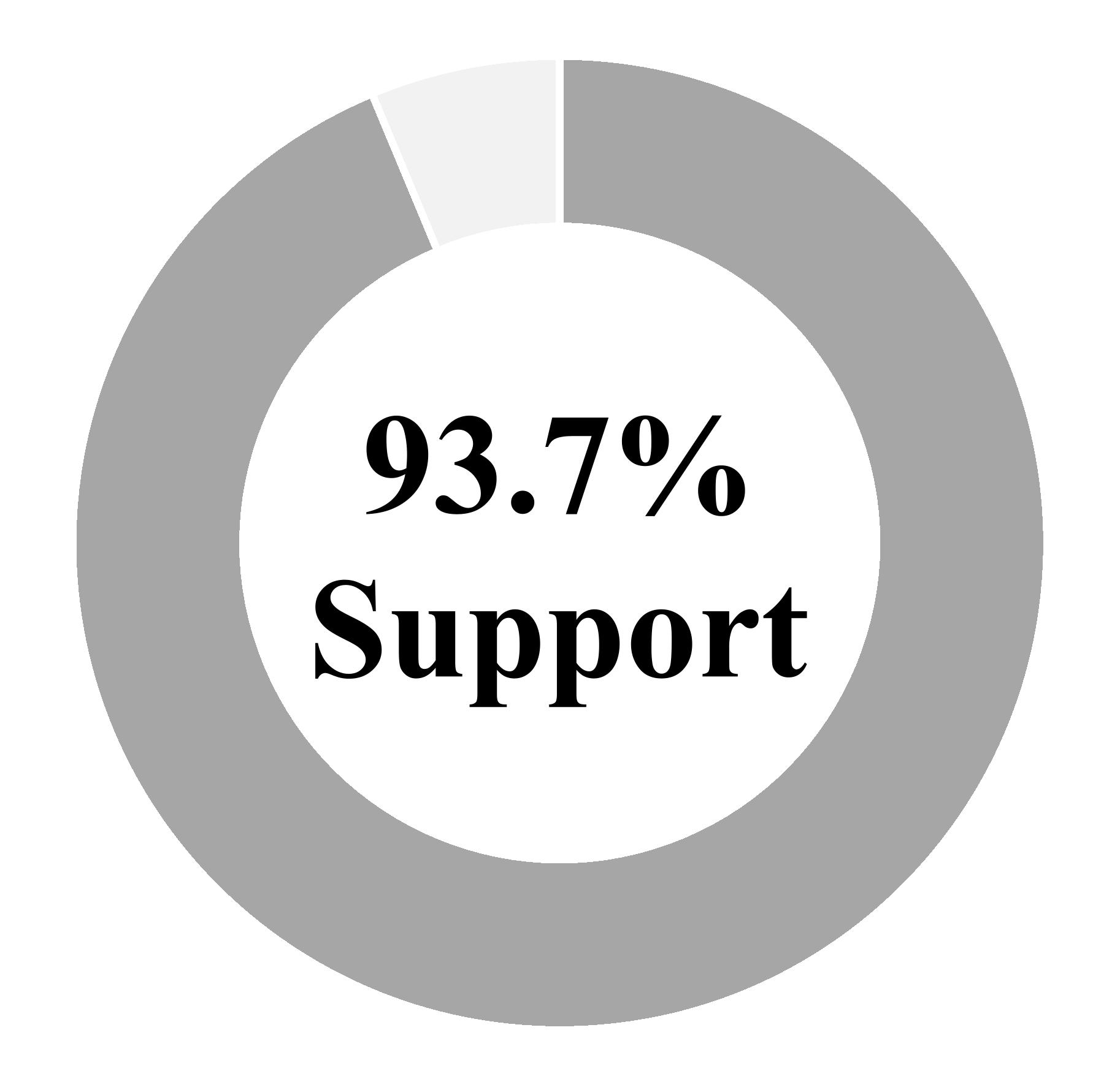

The affirmative vote of a majority of all the votes cast by holders of Common Shares in person or by proxy at the Annual Meeting is required to approve the non-binding advisory resolution approving the Company's executive compensation program for Named Executive Officers as set forth in this Proxy Statement. Because the shareholder vote is advisory, the results will not be binding upon the Board.binding. However, the Compensation Committee and the Board will take the outcome of the vote expressed by the shareholders into consideration for future executive compensation arrangements.

The Board of Trustees unanimously recommends that the shareholders vote "FOR"“FOR” the approval, on a non-binding advisory basis, of the Company's compensation program for Named Executive Officers as set forth in this Proxy Statement.

Unless otherwise indicated by a shareholder on a proxy and except with respect to broker non-votes, shares will be voted "FOR"“FOR” the approval of the executive compensation.

Because this proposal is a non-routine matter under the rules of the New York Stock Exchange,NYSE, brokerage firms, banks and other nominees who hold Common Shares on behalf of clients in "street name"“street name” are not permitted to vote such Common Shares if the client does not provide instructions.

For additional information regarding voting requirements, see "Outstanding“Outstanding Shares and Voting Rights"Rights” above.

BOARD OF TRUSTEES

Trustee Meetings and Attendance

During 2021,2023, the Board of Trustees held sixthree telephonic meetings and four in person meetings, the Audit Committee held five telephonic meetings, the Compensation Committee held sixone telephonic meeting and two in person meetings, the Nominating and Corporate Governance Committee held four telephonic meetings and one in person meeting, and the Investment/Capital Markets Committee held numerous telephonic discussions to discuss potential transactions. The Board of Trustees believes consistent attendance with a minimum of missed meetings is important in carrying out the responsibilities of being a Trustee. In 2023, each incumbent Trustee attendanceattended at least 75% of (i) the total number of meetings of the Board held during the period for which he or she was a Trustee, and (ii) the total number of meetings of all committees of the Board and committee meetings was 99%.on which the Trustee served during the periods that he or she served.

13

The Company does not have a formal policy requiring Trustees to be present at the Annual Meeting, although the Company does encourage their attendance. All of the Trustees virtually attended the 20212023 Annual Meeting of Shareholders.

Board Leadership Structure

The Board'sBoard’s Lead Trustee and the Company's Chief Executive OfficerCEO generally provide leadership of the Board. The Company does not have a chairperson of the Board. Mr. Wielansky, an independent Trustee who serves as a member of the Investment/Capital Markets Committee, has been selected by the Board to serve as the Lead Trustee. The duties of the Lead Trustee include, without limitation, the following:

The Lead Trustee has final say on the agenda for all Board meetings.

The Chief Executive OfficerCEO presides over the regular meetings of the Board of Trustees, calling each meeting to order and leading the Trustees through the agenda items. The Lead Trustee presides over all meetings of non-management Trustees held in executive session. "Non-management"“Non-management” Trustees are all those who are not Company officers and include Trustees, if any, who are not "independent"“independent” by virtue of the existence of a material relationship with the Company (although all of the current non-management trustees are also

12

independent). An executive session is held in conjunction with each regularly scheduled Board meeting and other executive sessions may be called by the Lead Trustee in his own discretion or at the request of the Board. The Lead Trustee's responsibilities are more fully described in the Company's Corporate Governance Guidelines, which are available on the Company's website at www.acadiarealty.com in the "Investors“Investors - Corporate Governance"Governance” section. Please note that the information on, or accessible through, the Company's website is not incorporated by reference in this Proxy Statement.

Because the Chief Executive OfficerCEO is the Trustee most familiar with the Company's business and industry and best equipped to effectively identify strategic priorities and lead the discussion regarding the execution of the Company's strategy, he usually leads discussion at Board meetings. Independent Trustees and management have different perspectives and roles in strategy development. The Company's independent Trustees bring experience, oversight and expertise from outside the Company, while the Chief Executive OfficerCEO brings company-specific experience and expertise. The Board believes that its leadership structure is appropriate because it results in an appropriate balance between independent leadership through the use of a Lead Trustee and strategic considerations, which result from the Chief Executive OfficerCEO leading the discussions on most Board topics.

Committees of the Board of Trustees

The Board of Trustees has standing Audit, Compensation, Nominating and Corporate Governance and Investment/Capital Markets Committees. Each committee has the authority to obtain advice and assistance from outside legal, accounting or other advisors as deemed appropriate to perform its duties and responsibilities.

The functions of each committee, are detailed in its respective committee charter, which may be found, in addition to the Company's Corporate Governance Guidelines, Code of Business Conduct and Ethics and Whistleblower Policy, on the Company’s website at www.acadiarealty.com in the "Investors“Investors - Corporate Governance"Governance” section. Please note that the information on, or available through, the Company's website is not incorporated by reference in this Proxy Statement. Copies of these materials are also available to shareholders upon written request to the Company's Corporate Secretary, Acadia Realty Trust 411 Theodore Fremd Avenue, Suite 300, Rye, New York 10580.

14

Audit Committee

The Audit Committee has authority to engage the Company's independent registered public accounting firm and review the scope and results of the audit. The Audit Committee examines the accounting practices and methods of control and the manner of reporting financial results. These reviews and examinations include meetings with independent auditors, staff accountants and representatives of management. The results of the Audit Committee's examinations and the choice of the Company's independent registered public accounting firm are reported to the full Board of Trustees. The Audit Committee includes no officers or employees of the Company or any of its subsidiaries.

The Audit Committee Charter requires that the Audit Committee be comprised of at least three members, each of whom is "independent,"“independent,” as defined by the listing standards of the New York Stock ExchangeNYSE and at least one of whom is an "audit“audit committee financial expert,"” as that term is defined by the SEC.

The following Trustees are members of the Audit Committee: Ms. Thurber (Chair), Ms. Luscombe, Mr. Spitz and Mr. Kellar. Mr. Kellar and Ms. Luscombe have served as members of the Audit Committee as of the end of the last fiscal year were: Ms. Thurber (Chair), who has served since 2004,2016, Mr. Denien, who has served since 2022, Mr. Spitz, was appointed a member inwho has served since 2010, and Ms. ThurberMr. McIntyre, who has been on the Audit Committeeserved since 2016.2023. The Board has determined that each of these members meets the independence requirements for members of audit committees prescribed by the listing standards of the New York Stock Exchange.NYSE. The Board has determined that Mr. Kellar, Ms. LuscombeMessrs. Denien and McIntyre and Ms. Thurber are each an "audit“audit committee financial expert,"” as that term is defined by the SEC. See the biographical information for Ms. Thurber, Mr. Denien, Mr. McIntyre and Mr. Spitz in "PROPOSAL“PROPOSAL 1 - ELECTION OF TRUSTEES"TRUSTEES” for their relevant experience.

Compensation Committee

The Compensation Committee is responsible for administering the Company’s incentive plan and recommending to the full Board the compensation of the executive officers of the Company. The Compensation Committee, either as a Committeecommittee or together with the other independent Trustees (as directed by the Board), is responsible for determining and approving the Chief Executive Officer'sCEO’s compensation level. In addition, the Compensation Committee evaluates the Chief Executive Officer'sCEO’s performance, coordinates and reviews the Company's succession plans related to the Chief Executive OfficerCEO and other executive officers and reports the status of such plans to the Board annually.

The Compensation Committee Charter requires that the Compensation Committee be comprised of at least two members, with all committee members being "independent"“independent” as defined by the listing standards of the New York Stock Exchange.NYSE.

The members of the Compensation Committee duringas of the end of the last fiscal year werewere: Messrs. Spitz (Chair), Kellar and Crocker and Ms. Thurber. Mr. Spitz and Mr. Crocker have served as members since 2007, Mr. Kellar has served as a member since 2004 and Ms. Thurber has served as a member since 2016. The Board of Trustees has determined that each of these members is independent within the meaning of the listing standards of the New York Stock Exchange.NYSEf. See "Acadia“Acadia Realty Trust Compensation Committee Report"Report” below.

For information relating to the compensation consultant hired by the Compensation Committee, see "Role“Role of the Independent Compensation Consultant and Use of Peer Group Data"Data” in "Compensation“Compensation Discussion and Analysis"Analysis” below.

Compensation Committee Interlocks and Insider Participation

During 2021,2023, none of the Compensation Committee members (i) were officers or employees of the Company or any of its subsidiaries; (ii) were former officers of the Company or any of the Company's subsidiaries or (iii) had any relationship with the Company requiring disclosure under Item 404 of Regulation S-K. In addition, during the last completed fiscal year, none of the executive officers of the Company served as:

15

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee is responsible for reviewing the qualifications and performance of the Board of Trustees and recommending nominees for Trustees and Board committee membership to the Board. The Nominating and Corporate Governance Committee is also responsible for recommending to the Board changes in the Company's Corporate Governance Guidelines and overseeing the Company’s ESG efforts. The Nominating and Corporate Governance Committee Charter requires the Nominating and Corporate Governance Committee to be comprised of at least two members, each of whom is "independent"“independent” as defined by the listing standards of the New York Stock Exchange.NYSE.

MembersThe members of the Nominating and Corporate Governance Committee duringas of the end of the last fiscal year were Ms. Luscombewere: Mr. Zoba (Chair), who has served since 2005,2015, Mr. McIntyre, who has served since 2021, Mr. Crocker, who has served since 2005, Mr. Zobaand Ms. Woodhouse, who has served since 2015, and Mr. McIntyre, who has served since 2021.2023. The Board of Trustees has determined that these members are independent within the meaning of the listing standards of the New York Stock Exchange.NYSE.

The Nominating and Corporate Governance Committee will consider all shareholder recommendations for candidates for the Board of Trustees. All shareholder recommendations should be sent to the Company's Corporate Secretary at Acadia Realty Trust, 411 Theodore Fremd Avenue, Suite 300, Rye, New York 10580, and should include all information relating to such person that is required to be disclosed in a proxy statement for the election of Trustees or is otherwise required pursuant to Regulation l4A under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).Act. Shareholders must also include the nominee's written consent to being named in the proxy statement as a nominee and to serving as a Trustee if elected. Furthermore, the shareholder giving the notice and the beneficial owner, if any, on whose behalf the recommendation is made must include their names and addresses as they appear on the Company's books, as well as the class and number of Common Shares of the Company that they beneficially own. The Nominating and Corporate Governance Committee may identify other candidates, if necessary, through recommendations from Trustees, management, employees or outside consultants. The Nominating and Corporate Governance Committee will review candidates in the same manner regardless of the source of the recommendation. The Committee received no shareholder recommendations for candidates for the Board of Trustees for this Annual Meeting. Under the Company's current Bylaws, if a shareholder wishes to put forward a nominee for Trustee, it must deliver notice of such nominee to the Company's Corporate Secretary not less than 120 days and no more than 150 days prior to the first anniversary date of the proxy statement for the preceding year's annual meeting, provided, however, that in the event that the date of the annual meeting is advanced or delayed by more than 30 days from the anniversary date of the preceding year's annual meeting, notice by the shareholder must be so delivered not earlier than the 150th day prior to such annual meeting and not later than 5:00 p.m.,

14

Eastern Time, on the later of the 120th day prior to such annual meeting or the tenth day following the day on which public announcement of the date of such annual meeting is first made. See "Submission“Submission of Shareholder Proposals"Proposals” below.

Trustee Qualifications and Review of Trustee Nominees

The Nominating and Corporate Governance Committee makes recommendations to the Board of Trustees regarding the size and composition of the Board. The Nominating and Corporate Governance Committee annually reviews the composition of the Board as a whole and recommends, if necessary, measures to be taken so that the Board reflects the appropriate balance of knowledge, experience, skills, expertise and diversity of backgrounds and contains at least the required minimum number of independent Trustees. The Nominating and Corporate Governance Committee is responsible for ensuring that the composition of the Board accurately reflects the needs of the Company to execute its strategic plan and achieve its objectives. In the event the Nominating and Corporate Governance Committee determines that additional expertise is needed on the Board, or if there is a vacancy, the Nominating and Corporate Governance Committee expects to use its network of contacts to compile a list of potential candidates, but may also engage, if it deems appropriate, a professional search firm.

The Company's strategic plan can be summarized in the following broad categories:

In evaluating a Trustee candidate, including existing Trustees being recommended for re-nomination, the Nominating and Corporate Governance Committee considers factors that are in the best interests of the Company, including the knowledge, experience, integrity and judgment of the candidate; the potential contribution of the candidate to the diversity of experience, competencies, and backgrounds, including diversity with respect to race, gender, and geography required by the Board; the candidate's ability to devote sufficient time and effort to his or her duties as a Trustee; independence and willingness to consider all strategic proposals and oversee the strategic direction of the Company; and any other criteria established by the Board, as well as other core competencies or technical expertise

16

necessary to fill all of the committees of the Board. The Nominating and Corporate Governance Committee formally committed in its charter to seek to include candidates with a diversity of race, ethnicity, and gender in the pool from which it selects Trustee candidates. All nominees are screened for conflicts of interest that would interfere with service on the Board.

The Nominating and Corporate Governance Committee will seek to ensure that each nominee meets the foregoing criteria and also brings a strong and unique background and set of skills to the Board, giving the Board, as a whole, competence and experience in a wide variety of areas:

15

After completing its evaluation process, the Nominating and Corporate Governance Committee recommends to the Board the nomination of Trustee candidates and the Board then selects the Trustee nominees for shareholders to consider and vote upon at the annual meeting of the shareholders.

Investment/Capital Markets Committee

The Investment/Capital Markets Committee (the "Investment Committee"“Investment Committee”) has been established for the primary purpose of (i) screening all transactions that are within certain defined pre-approval limits to ensure such transactions are within such limits, (ii) acting as the pricing committee for all equity offerings and (iii) for other investments and capital market transactions, exercising such authority as is given to it from time to time by the Board of Trustees.

The Investment Committee Charter requires that it be comprised of at least three members, each of whom is "independent"“independent” as defined by the listing standards of the New York Stock Exchange.NYSE. The Investment Committee Charter also provides that Company's Chief Executive OfficerCEO is a member of the Investment Committee by virtue of his executive position. The members of the Investment Committee as of the end of the last fiscal year were: Messrs. Crocker (Chair) and Wielansky, who have each served as the members of the Investment Committee since the 2004 Annual Meeting, Mr. Spitz, who has served since 2007, and Mr. Zoba, who has served since November 2015. The Board of Trustees has determined that Messrs. Crocker, Wielansky, Spitz and Zobathese Trustees (other than the CEO) are "independent"“independent” within the meaning of the listing standards of the New York Stock Exchange.NYSE.

CORPORATE GOVERNANCE HIGHLIGHTS

WHAT WE DO

The Company regularly monitors developments in the area of corporate governance and seeks to enhance the Company's corporate governance structure based upon a review of new developments and recommended best practices, taking into account investor feedback. We believe that sound corporate governance strengthens the accountability of our Board and management, and promotes the long-term interests of our shareholders. Our Corporate Governance Guidelines and associated policies mandate an elevated level of excellence from our company, the Board and management. Through transparency, alignment of interests, and removal of potential conflicts of interests, we seek to ensure that our decisions and actions advance the interestsof our shareholders, employees, and other stakeholders.

Below are the highlights of our independent Board and leadership practices:

17

16

18

ENVIRONMENTAL, SOCIAL AND GOVERNANCE (“ESG”) ACHIEVEMENTS AND INITIATIVES

We believe that responsible environmental and social stewardship and ethical corporate governance are an essential part of our mission to build a successful business and create long-term value for our Company and our stakeholders. We have established both ESG and human rights policies. We have a multi-disciplinary ESG Committee, including several senior executives, steering our ESG Program, which is overseen by our Nominating and Corporate Governance Committee. Below are select achievements and initiatives of our ESG Program that illustrate our commitment to ESG principles.

REPORTING

We are committed to providing transparency and quantitative reporting around our ESG performance. Our ESG strategy, qualitative and quantitative goals, and performance are described in more detail in our annual Corporate Responsibility Report which can be found on our website at https://www.acadiarealty.com/sustainability/environmental. In 2021, we expanded the alignment of our Corporate Responsibility Report with the TCFD and SASB reporting frameworks. Please note that the information on, or accessible through, the Company’s website is not incorporated by reference in this Proxy Statement.

Environmental SUSTAINABILITY

We are committed to understanding the environmental impact of our operations and promoting environmental sustainability while maintaining high standards for our Company and our stakeholders. We have undertaken numerous green initiatives, including the following:

17

SOCIAL

18

Governance

We are dedicated to maintaining a high standard for corporate governance predicated on integrity, ethics, diversity and transparency. All of our board members stand for re-election every year. We seek to maintain a diverse Board primarily comprised of independent Trustees who represent a mix of varied experience, backgrounds, tenure and skills to ensure a broad range of perspectives is represented. In 2021, our Nominating and Corporate Governance Committee formally committed in its charter to seek to include candidates with a diversity of race, ethnicity and gender in the pool from which it selects Trustee candidates. As of the date of this proxy statement, two of our eight independent Trustees represent gender diversity and one independent Trustee represents racial and ethnic diversity.

Additionally, we regularly monitor developments in the area of corporate governance and seek to enhance our corporate governance structure based upon a review of new developments and recommended best practices, taking into account investor feedback. We believe that sound corporate governance strengthens the accountability of our Board and management and promotes the long-term interests of our Company and shareholders. Refer to page 16 for an outline of our governance highlights.

Our Corporate Governance Guidelines and associated policies mandate an elevated level of excellence from our Company, our Board and management. Through transparency, alignment of interests, and removal of potential conflicts of interests, we ensure that our decisions and actions advance the interests of our Company, shareholders, employees and other stakeholders.

Shareholder Outreach

Outreach.Our Board and senior management believe that engaging in shareholder outreach is an essential element of strong corporate governance. We strive for a collaborative approach on issues of importance to investors and continually seek to understand better the views of our investors. Our senior management team engages with our shareholders throughout the year in a variety of forums and discusses, among other things, our business strategy and overall performance, executive compensation program, corporate governance and corporate governance.other ESG matters.

19

Trustees.

You may communicate directly with the Board of Trustees by sending correspondence to the Company's Corporate Secretary at Acadia Realty Trust, 411 Theodore Fremd Avenue, Suite 300, Rye, New York 10580. The sender should indicate in the address whether it is intended for the entire Board, the independent Trustees as a group, or to an individual Trustee. Each communication intended for the Board, the independent Trustees or an individual Trustee received by the Corporate Secretary will be promptly forwarded to the intended recipients in accordance with the sender's instructions.The entire by Full Board and eachCommittees.

Financial and Accounting

The Board and the Audit Committee monitor the Company's financial and regulatory risk through regular reviews with management and internal and external auditors and other advisors. In its periodic meetings with the internal auditors and the independent registered public accounting firm, the Audit Committee discusses the scope and plan for the internal audit and the audit conducted by the independent registered accounting firm, and includes management in its review of accounting and financial controls and assessment of business risks.

Governance and Succession

The Board and the Nominating and Corporate Governance Committee monitor the Company's corporate governance policies and procedures by regular review with management and outside advisors. The Board and the Compensation Committee monitor CEO succession and the Company's compensation policies and related risks by regular reviews with management and the Committee's outside advisors.

Cyber SecurityCybersecurity

Cyber securityCybersecurity is an integral part of the Board’s and the Audit Committee’s risk analysis and discussions with management. The Company prides itselffollowing are highlights of the Company’s cybersecurity risk management practices:

19

Compensation

Compensation

As part of its oversight of the Company's executive compensation program, the Compensation Committee considers the impact of the Company's executive compensation program, and the incentives created by the compensation awards that it administers, on the Company's risk profile. In addition, the Company reviews all of its compensation policies and procedures, including the incentives that they create and factors that may reduce the likelihood of excessive risk taking, to determine whether they present a significant risk to the Company.

Ethics.

The Board adopted a Code of Business Conduct and Ethics, which governs business decisions made, and actions taken by, our Trustees, officers and employees. A copy of the Code of Business Conduct and Ethics is available on our website at www.acadiarealty.com under the heading “Investors” and subheading “Corporate Governance”. Please note that the information on, or available through, the Company's website is not incorporated by reference in this Proxy Statement. We intend to disclose on our website any amendment to, or waiver of, any provision of the Code of Business Conduct and Ethics applicable to our Trustees and executive officers that would otherwise be required to be disclosed under the rules of the SEC or theENVIRONMENTAL SUSTAINABILITY & SOCIAL RESPONSIBILITY

MANAGEMENTWe seek to drive financial performance while engaging in environmentally and socially responsible business practices grounded in sound corporate governance.